Rogue Traders….

The last 12 months have caused me to think back 30 years to my very early days in this business. 1990. As a kid growing up in the 80s, with a car nut Dad, I watched classic car values rise steeply. It appeared the nearer I got to actually obtaining a driving license, the cars that the spotty Barney loved and dreamt of owning, just got more expensive. It was becoming quite depressing realising I may never get to own any of these cars, unless I was to benefit from the death of a distant, unknown, elderly Aunt, lining my pockets with a pile of dosh and a country estate. I’m still waiting!

The steep rise in classic car values over the last decade had many influences, causing prices to soar, the single biggest factor being the lowest interest rates ever seen. Money in the bank simply devalues every year. The credit crunch of 2008 was a recession of the like we had never seen before and, unlike the early 1990s recession, when cash was king due to double figure interest rates, 2008 onwards saw assets become the preferred and wise choice of investment. The classic car market, as an asset class, outperformed everything else for a decade. Extraordinary!

As a result, we have seen the amount of classic car dealers, repairers and restorers triple over the last decade. I ponder where all these marque specialists came from? Then there is the spin-off businesses that have benefitted from our ever increasing love of cars. Motoring events, classic car finance, storage companies, specialist insurers, car detailers, motoring websites, specialist social media, motoring artwork, automobilia and a whole new genre of TV programs, to name but a few.

Even the late 1980s classic car boom, never saw growth in values as fast as the last ten years. What goes up must come down though and any market that rises so steeply, simply is not sustainable. No question, today’s market place has softened over the last 18 months. The older of us, who still have our marbles and memories, knew this market would not continue skyrocketing forever. The classic car market needs a period of reflection, giving us all time to adjust to today’s values.

The B word is of course affecting all markets now and the total lack of decision making and moving forward with plans, is seen in so many industries. It’s terribly sad to watch our economy stagnating and so many ideas and opportunities being shelved until we have certainty.

So, what’s going on today? Some car prices are falling, no doubt. That said, the people that listened to good advice and bought the best, are finding their pride and joy is holding up well. These cars that have all the boxes ticked are not falling in price. One may have expected to see a switch from a seller’s to a buyer’s market and yet this has not happened. The best cars tended to be purchased by people who loved them and bought with a medium to long term view. They were true car enthusiasts who now had the financial comfort to enjoy a few of those childhood dream cars. They do not need to sell in a hurry. They bought them to enjoy and own over 15-25 years. The simply do not care if the market takes a 20% dip while the UK sorts itself out, as they were never selling.

At the other end of the spectrum, we are seeing the early signs of panic. The people who simply joined in out of greed, assuming all things would continue to escalate in value and double every 4-5 years, are now trying to jump ship.

They often bought the cheaper cars with crosses in boxes thinking they could be bought cheap, titivated and sold high. That was never the case. These cars always fail proper due diligence by true marque specialists. This demand from purely speculative buyers, dramatically pushed prices of the average up, way beyond their true worth. It’s these poor to mediocre cars that are now falling in price and this market is starting to become a buyer’s market.

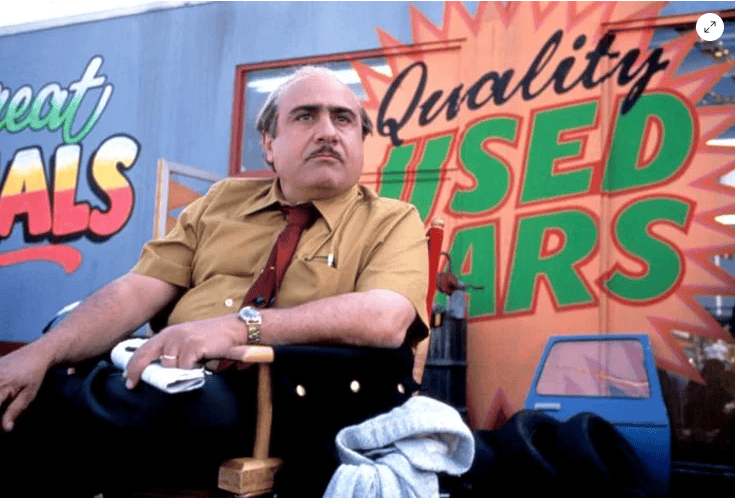

Unfortunately, this change in market trend is bringing out the horror stories. In fact, I would say I have one conversation a day at the moment with a member of the public who is suffering because of appalling behaviour by a classic car dealer. Some dealers, especially the ones with gearing, are starting to feel the pain and their businesses are suffering. This pain is being passed on to their customers. In short, their bad cash flow is causing the level or preparation work to cars that they have sold slip and get carried out to poor standards, if at all. The greater problem I see happening more and more is with the customers who have left cars with dealers to sell on their behalf. Again, the poor cash-flow in these businesses now means that many dealers are operating Ponzi schemes and the pyramid is now starting to collapse. We are seeing the problem of dealers not paying customers for cars they have sold increasing by the week. These business are starting to disappear, with a few having recently been put into administration.

I do think there is good news ahead. This plateau classic cars have reached will drive out the greedy from an industry that has forgotten to put the customer first. The dead wood will drift away and look for other opportunities elsewhere, leaving the truly knowledgeable and reputable dealers to get on with the job of selling, maintaining and restoring customers’ cars well, whilst keeping it fun.

In the meantime, apply great caution, especially if buying or selling.